- 1. Research is Key: Always do research before investing in any crypto. Stay active on Crypto Twitter.

- 2. Diversify Investments: Spread your money across different cryptocurrencies and platforms to lower risks. Never put all your funds into one coin or method.

- 3. Stay Updated: Follow news, use market trend tools, and join crypto communities to stay informed. The market changes fast!

- 4. Smart Earning Methods: Yield farming, staking, trading, playing-to-earn games, mining, lending, and affiliate programs offer great ways to earn passive income with crypto.

- 5. Be Cautious of Risks: Crypto has high volatility and security risks. Keep your assets safe using secure wallets and stay aware of potential scams.

Making money with crypto can seem tricky, but it’s full of opportunities this year.

With trending cryptocurrencies like $SOL or $BTC, there are 12 profitable ways to earn income.

These include mining, staking, trading, investing, lending, earning interest and affiliate programs.

I have been part of the crypto world since 2016 and have invested in various projects.

In this guide, I will share how to make money with crypto based on my experiences and what I’ve learned over the years.

The content provided in our publications is for informational and entertainment purposes only. The information contained herein should not be construed as professional advice, recommendation, or endorsement.

This post related to investments, cryptocurrency, or financial matters is no financial advice. All investments carry risk. Past performance does not guarantee future results. Readers should conduct their own research and consult qualified financial advisors before making any investment decisions.

Simple methods to earn passive income with crypto

We have several methods for earning passive income with crypto. Some require minimal effort, while others need a bit more work and time...

Earn passive income with yield cultivation

Yield farming can bring in passive income.

We earn through lending on DeFi platforms and decentralized exchanges (DEXs).

By connecting wallets and committing our crypto to lending pools, we get rewards based on the loan duration, amount, and interest rate.

Top lending platforms in 2026 are Uniswap, Curve, and Balancer.

Trustworthy platforms are a must for yield farming.

Notable exchanges include Uniswap , Pancakeswap , and Sushiswap . These help us earn from the liquidity we provide... A great way to make our crypto work harder!

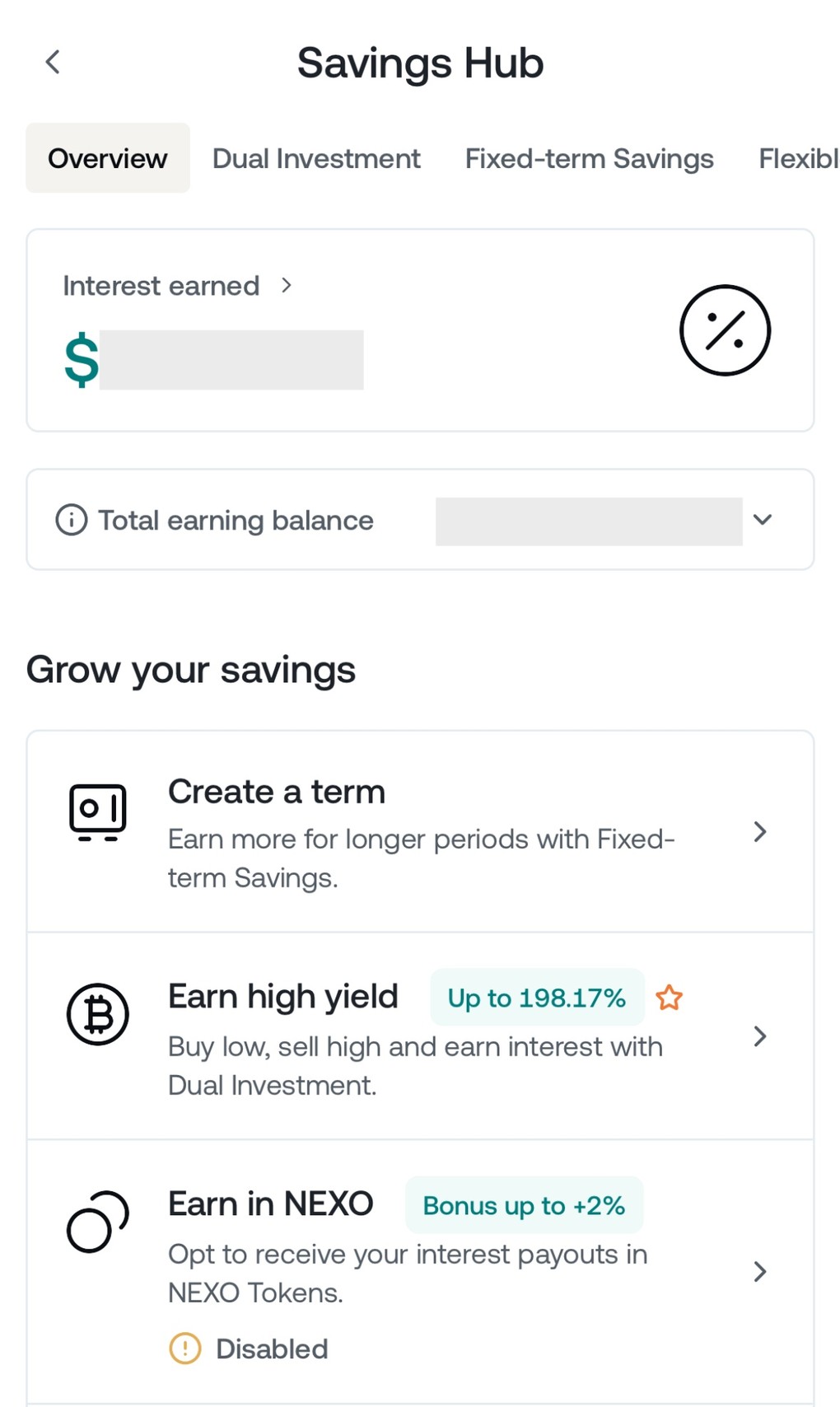

Yield farming does also work with centralized platforms / exchanges like Nexo or Binance .

They offer up to 200% APY on different assets with high-risk assets, and up to 16% APY with relatively safe conditions.

Still, all carry risks, but are plausible ways to earn passive income.

Crypto mining requires quality GPUs and technical skills, but is still relevant

Mining crypto requires some dedication and skill!

We need a good GPU and technical know-how to get started.

Bitcoin mining uses proof-of-work (PoW) for blockchain validation, which needs lots of electricity.

As we mine, the block reward halves every four years, lowering our earnings over time (what everyone recalls as the halving).

Litecoin reduces its rewards by 20%.

It’s important to research because mining may not always be profitable due to costs and equipment wear.

Joining a mining pool can help us share resources and improve our chances of earning block rewards.

Let's use tools like hardware wallets for security during this process!

Earn passive income by holding cryptocurrency

Staking offers a great way to earn passive income.

We stake our cryptos on proof-of-stake (PoS) blockchains like Cardano and Polkadot. This helps secure the network, and we get rewards for it.

Also ETH offers staking possibilities.

Look into different PoS blockchains, find the one with the best staking rewards, and fits your investment goals. Good luck!

We can use exchanges or wallets to stake coins easily.

Binance has a wide offering of staking instruments .

Some blockchains like EOS even let us delegate our coins to validator nodes, which means less work for us but still good returns. Staking needs less tech knowledge compared to mining cryptocurrency, making it more user-friendly.

Earn income by playing crypto games

We love staking, but there's more fun to be had with crypto.

Playing-to-Earn games are a hot trend right now.

These games let us make money while having fun—no joke!

For example, Axie Infinity and Decentraland are great choices.

Start with games that have a big fanbase and good support, it'll help you make more money!

In these games, we can earn rewards or get tradable assets.

It's not all play; initial investments are often needed. Yet, the gaming sector in crypto is growing fast... Worth checking out for some extra income!

Protect your coins from hackers and fraud

Security is a must in crypto.

Hackers love digital currencies... and they’re good at getting them. Centralized platforms can fail, leaving us high and dry. (De-)centralized platforms have vulnerabilities too.

Keep your security software up-to-date and use two-factor authentication to protect yourself from potential threats.

It's always good to be a little extra safe, right? :)

We need secure storage options like hardware and software wallets. Online exchanges can be risky but useful if managed well.

Research is key to avoid fraudulent tokens—don’t skip it!

Let’s stay safe while making money with our digital currencies!

Crypto prices can lead to significant losses

Losses happen in crypto.

Prices can drop fast, causing big capital losses due to price volatility. We may think we have a solid investment, but the market changes quickly.

Expected returns might not materialize.

Mining profitability decreases over time too.

As more miners join, the rewards get smaller. Cryptocurrency investments are also not insured or backed by government entities... so there's no safety net in place!

Just set stop-loss orders to keep your investments safe from sudden market drops. You know, just in case the market takes a big dive.

Crypto earnings come at a cost

Earning passive income with crypto has its costs. Mining needs pricey equipment and lots of electricity. We have spent a chunk on high-end computers and pay hefty energy bills every month.

Storing cryptocurrency securely also costs money.

Buying hardware wallets for safety isn't cheap, but it's essential to keep our assets secure. Play-to-Earn games require an initial investment too—sometimes hundreds of dollars—to get started.

Alright, I'll check out some Play-to-Earn games that don't need a lot of money to start and could give you more back.

These are just some associated costs we need to consider when making money with crypto.

Scams are everywhere in cryptocurrency.

Many tokens on DEXs can be fake or worthless.

We must do our research to avoid getting scammed. Look at the project's team and whitepaper before buying any new token.

Scammers often promise quick profits, but they just want your money. Never share your private keys or personal info with anyone you don't trust completely.

Be cautious of too-good-to-be-true deals; it's better to miss out than lose everything.

Research assists you in selecting the right crypto coin

Choosing the right crypto coin is key.

Research comes first.

Look at a coin’s history and use Token Metrics for data. This helps spot trends and make informed choices.

Consider your risk tolerance too. Some coins are more volatile than others. Ask a financial adviser if unsure. No coin guarantees success but smart choices can pay off!

Especially when going for memecoins, use tools like rugcheck.xyz to check tokens on Solana.

Crypto trading: high risk, substantial rewards

Trading crypto carries high risk, but it can also bring big rewards.

Prices are unstable and change fast. We need to be ready for those swings.

We should study the market trends before making trades.

But investing in crypto doesn't have to be about constant trading.

It can be about holding and watching your assets grow.

We can invest in individual cryptocurrencies or diversified funds. Each option has its own risks and rewards.

Individual risk tolerance is key here.

Some of us might be fine with high-risk altcoins, while others prefer stable assets like Bitcoin or Ethereum. Secure storage is also crucial—whether we use hardware wallets, software wallets, or online exchanges, security can't be ignored.

Keep your crypto wallet safe by updating and backing up your info. You don't want to lose your assets, do you?

Earn income with crypto affiliate programs

Making passive income with crypto can get interesting... Affiliate programs offer a cool way to make money.

Many exchanges and services give commissions for bringing new users. We share links or codes, and when someone signs up using them, we earn.

Our experience shows that many platforms have these programs.

For example, Binance and Coinbase have generous offers—sometimes up to 50% of the fees paid by new users. This can add up fast! Just research each program before signing up (some may not be as good).

Stay smart; choose well-known brands.

ICOs offer high returns but involve risks

ICOs, or Initial Coin Offerings, offer a big chance for high returns. We buy tokens from new blockchain projects before they hit the market. Some famous examples include Ethereum and EOS.

But there's also a lot of risk; scams are common, and many ICOs fail.

To make good choices, we should do deep research.

Token Metrics can help us with detailed data to pick smart investments. It's wise to consult a financial advisor too.

That way, we protect our money and plan wisely for the future.

Also being active on Crypto Twitter (X) is helpful.

Keep up with the latest rules about cryptocurrency. This will help you follow the law and protect your investments.

Earn passive income on your conditions

Crypto gives us amazing flexibility.

We can earn passive income any time, anywhere.

Unlike stocks or bonds, we don't need to stick to a strict schedule. We choose when and how we invest based on our lifestyle.

Mix up your crypto investments to balance risks and rewards. No one wants all their eggs in one digital basket, right?

We also have different ways to earn with crypto—like yield farming, staking, and playing-to-earn games.

This lets us mix and match strategies that fit our goals...and risk tolerance!

Choosing crypto can free us from banks and other traditional financial institutions.

We don't need a bank account to trade, invest, or store crypto. Secure storage options include hardware wallets, software wallets, and online exchanges.

Crypto is accessible globally with just an internet connection.

This means we can participate in the economy without dealing with the usual red tape of banks.

The potential for earning interest through DeFi platforms adds another layer of independence from traditional methods like savings accounts or CDs.

Check out different DeFi platforms. Find the best interest rates and terms that fit your money goals. You know, like hunting for the best deal on Black Friday? :)

Profit from crypto with automated trading platforms and bots

Automated market makers help by providing liquidity on cryptocurrency exchanges.

They use algorithms to set prices based on supply and demand.

We have written a detailed list of available crypto trading bots.

And for more advanced users, check out algo crypto trading bots.

Don't forget tax planning for gains

Tax planning is crucial because capital gains from selling virtual currency can affect your Form 1040 filings.

Knowing how taxes work will save you a lot of headaches later.

![Banner image for How to make money with crypto [year]: 12 PROFITABLE ways](https://cdn.dehaupt.com/cdn-cgi/image/format=auto,metadata=none,onerror=redirect,fit=scale-down,width=800,blur=25,quality=90/https://storage.googleapis.com/img-betterchecked/raw/banner-19369116c76-0.png)

![Banner image for How to make money with crypto [year]: 12 PROFITABLE ways](https://cdn.dehaupt.com/cdn-cgi/image/format=auto,metadata=none,onerror=redirect,fit=scale-down,width=1400,quality=90/https://storage.googleapis.com/img-betterchecked/raw/banner-19369116c76-0.png)