- 1. A Bloomberg analyst says the deadline for Solana ETF approval is mid-March 2025.

- 2. People have mixed feelings, but they're optimistic.

- 3. Solana prices might go up if the ETF gets approved.

- 4. Security upgrades are crucial for institutions to start using it.

- 5. New ETF filings might accelerate approval.

- 6. Comparisons to Bitcoin ETF suggest a big market impact.

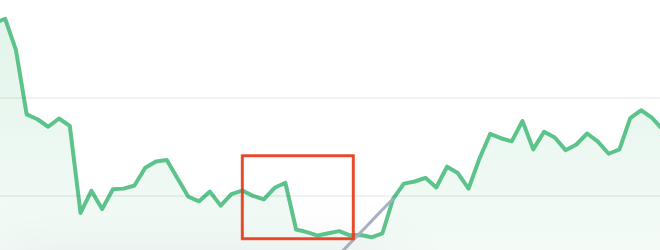

- 7. Expect market ups and downs near the cutoff.

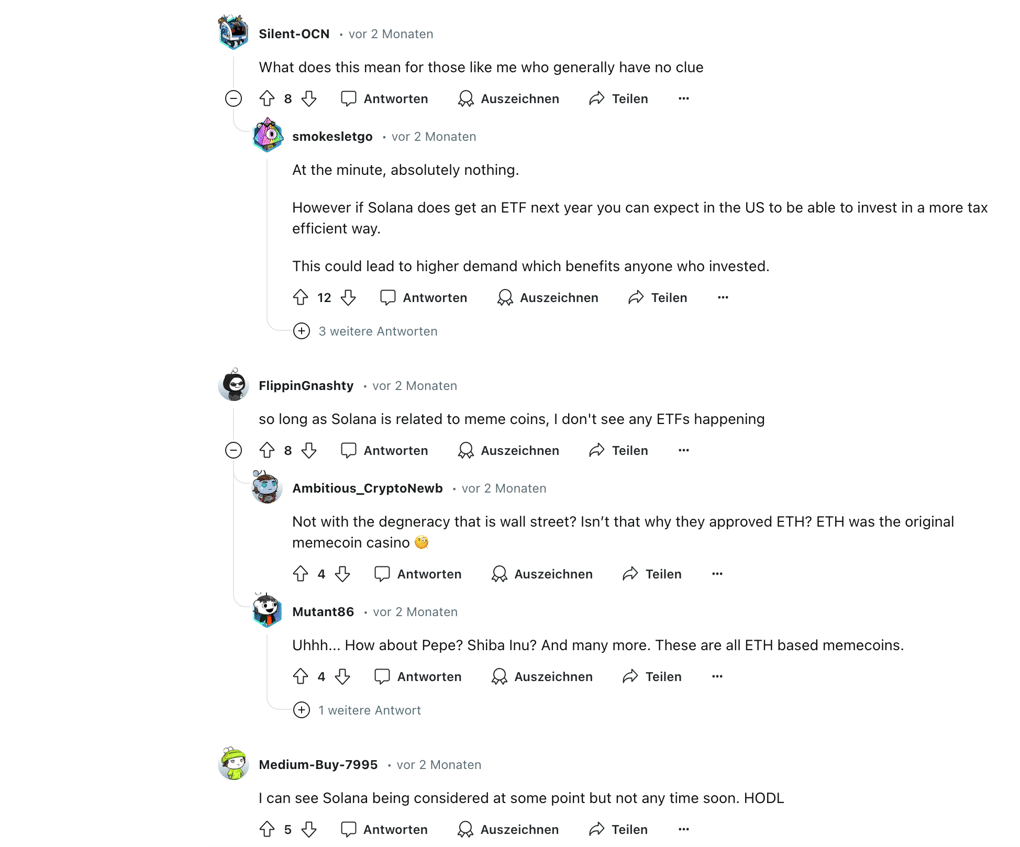

Solana's subreddit is buzzing with people sharing their thoughts and predictions. When analysts predicted that an ETF might get approved by mid-March 2025, discussions intensified.

Market analysts are also enthusiastic, stating that just the anticipation can make prices increase. However, not everyone shares this sentiment, with some pointing out that about 30% of ETF applications get delayed or rejected due to regulations, and worrying that Solana's security issues might slow down the approval process.

The community still remembers October 2022, when delays in Bitcoin ETF approval caused a 15% drop.

Looking at institutional investments, Solana has about $200 million, significantly less than Bitcoin's $35 billion, indicating that big investors are still cautious due to the risks.

There is a mix of hope and skepticism in the community.

While there's optimism, investors need to watch out for regulatory and security issues with Solana's ETF potential.

Solana's security review: a key step for ETF approval

Bloomberg analysts are examining Solana's security setup, which has experienced some issues, unlike Ethereum, which has undergone thorough audits.

During 2022, multiple significant hacks related to projects based to Solana resulted in the theft of more than $6 million, making people cautious about Solana.

To obtain ETF approval, Solana needs to address these security concerns, as large investors, who drive market growth, require strong security.

Recent updates demonstrate progress, with Solana partnering with CertiK , a renowned blockchain security auditor, to address security issues.

CertiK's audit aims to close security gaps, providing confidence to regulators and investors.

These audits are crucial, as they alter how people perceive the platform and build trust.

Strengthening security is key for Solana to get institutional trust and ETF approval. Investors should keep an eye on these changes.

Ethereum's experience is encouraging, with a major security update in 2021 leading to a 25% increase in its market cap over six months.

If Solana improves its security, it could attract significant investments, similar to Ethereum. Enhancing security is not only about complying with regulations; it is a strategic move to attract more institutional investments.

Potential price changes for SOL

Speculation on Solana's price is heating up as March 2025 approaches.

In the past, even rumors of ETF approvals have triggered price jumps. For instance, in October 2022, Bitcoin's price surged 12% in just two days due to an ETF rumor.

Analysts believe Solana might experience similar buy-ins before any official news. If the Solana ETF gets approved, the short-term price spike could be substantial.

However, there's a significant downside to consider. If the ETF gets rejected, prices might plummet. Analysts warn that we could see a 20-30% dip, similar to past ETF rejections.

Other market trends and significant economic factors also play a role. The crypto market reacts to global changes like interest rates and regulations.

Despite the risks, enthusiasm among investors remains high. They're balancing the potential for significant gains against the chance of losses, planning their moves carefully.

Investors should get ready for both gains and risks with Solana's ETF approval. Also, keep an eye on market trends, because no one can foresee the future.